Critical Illness Protection

What you need to know about critical illness protection and mortages

Critical illness protection is a type of insurance that is worth looking into if you are a working person with mortgage payments to maintain, but what exactly is it and how can it be helpful to you?

Critical illness cover: the basics

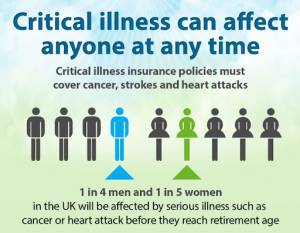

Critical illness insurance is designed to provide you with financial security if you or your partner should develop a serious illness like a stroke, heart disease, or cancer that leaves you unable to continue working. Typically, it will see your insurer pay a lump sum to you in the event of this and it is a form of insurance that many mortgage brokers will encourage you to consider if you are applying for a loan.

Critical illness protection and mortgage payments

A mortgage is a long-term commitment, but if you or your spouse fall victim to an illness that prevents you from earning a living, your ability to keep up the repayments will be at serious risk. Taking out a critical illness policy ensures that you will receive a payout in this situation that is tax free and yours to use as you see fit. This means that it can be used to pay off the remainder of your mortgage, which will remove the fear of losing your home.

This sounds great, but when it comes to the amount your policy will cost, there are factors that will influence the size of the premiums such as: your age, medical history, lifestyle and whether you have ever smoked.

Furthermore, the level of critical illness protection you need can vary depending on your income, the size of your mortgage, any additional debts you may have and whether you have other forms of insurance – for example income protection or health insurance.

It is possible to work out for yourself roughly how much critical illness cover you will need by calculating first your monthly debts and expenses and then the amount of protection you and your partner already have from other insurance policies and employee benefits like statutory sick pay. Subtracting the latter from the former will give you a basic idea. It is still worth getting expert advice though, to be absolutely sure you have the right amount of cover.

We are established Oxford mortgage brokers who offer mortgage advice and guidance on relevant insurance issues. Why not contact us now for a free consultation?